Oil Market Analysis Techniques

In the dynamic world of oil trading, having a robust set of analysis techniques is crucial for making informed decisions and maximizing profits. Let's explore some of the most effective methods used by successful traders in the oil market.

1. Fundamental Analysis

Fundamental analysis involves studying the underlying factors that affect oil prices. This includes:

- Global supply and demand trends

- Geopolitical events

- OPEC decisions

- Economic indicators

- Weather patterns affecting production and consumption

2. Technical Analysis

Technical analysis focuses on price movements and trading volumes. Key techniques include:

- Chart pattern recognition

- Moving averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Fibonacci retracements

3. Sentiment Analysis

Gauging market sentiment can provide valuable insights. Methods include:

- Social media monitoring

- News sentiment analysis

- Trader surveys

- Options market analysis

4. Quantitative Models

Advanced traders use sophisticated mathematical models to predict oil prices:

- Time series analysis

- Machine learning algorithms

- Neural networks

- Monte Carlo simulations

5. Inventory Reports Analysis

Regular analysis of inventory reports provides crucial data:

- EIA Weekly Petroleum Status Report

- API Weekly Statistical Bulletin

- OPEC Monthly Oil Market Report

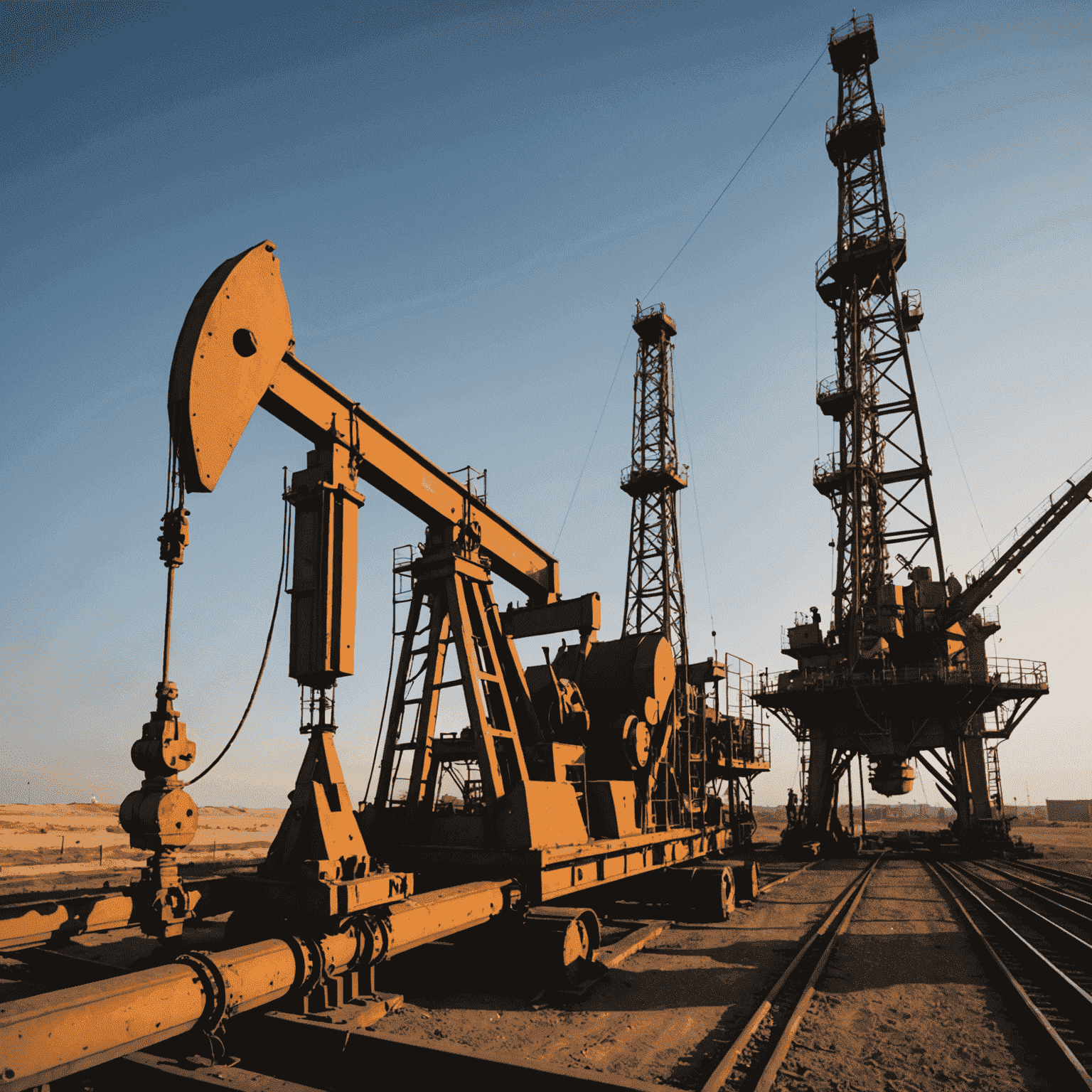

Conclusion

Mastering these oil market analysis techniques can significantly enhance your trading strategy. Remember, successful oil trading often involves a combination of these methods, along with continuous learning and adaptation to market changes. By leveraging these tools effectively, you can work towards building a smart passive income stream through oil trading over time.

Note: While our office in Canada provides support for traders, always conduct thorough research and consider seeking professional advice before making investment decisions in the oil market.